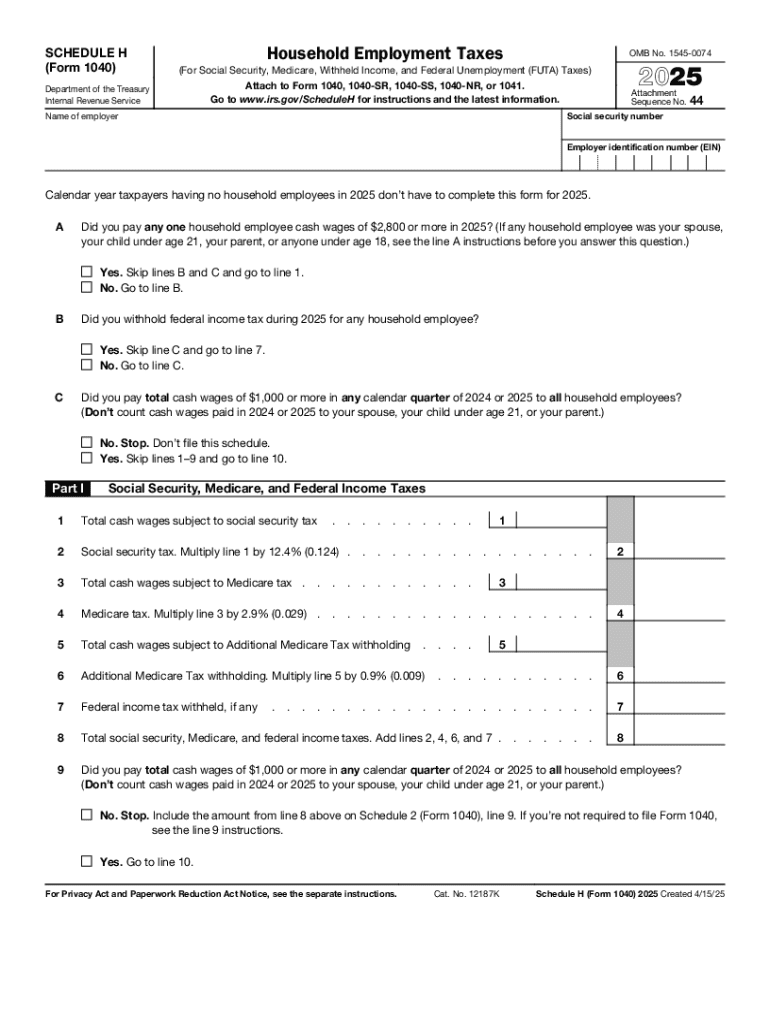

IRS 1040 - Schedule H 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

How to fill out IRS 1040 - Schedule H

Latest updates to IRS 1040 - Schedule H

All You Need to Know About IRS 1040 - Schedule H

What is IRS 1040 - Schedule H?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule H

What should I do if I discover an error after submitting my IRS 1040 - Schedule H?

If you find an error after filing your IRS 1040 - Schedule H, you can submit an amended return using Form 1040-X. Make sure to clearly explain the changes and keep a copy of your original submission for reference. Correcting mistakes promptly helps prevent complications during processing.

How can I track the status of my IRS 1040 - Schedule H submission?

To track the status of your IRS 1040 - Schedule H, you can use the IRS 'Where's My Refund?' tool if you're expecting a refund, or you can contact the IRS directly. Keep your Social Security number and filing status handy for faster assistance.

Are there specific considerations for filing IRS 1040 - Schedule H for nonresidents?

Nonresidents filing IRS 1040 - Schedule H must adhere to different guidelines compared to residents. It's crucial to verify your eligibility and understand any tax treaties that might apply. Using the right forms and including necessary documentation is essential for compliance.

What are some common errors to avoid when filing IRS 1040 - Schedule H?

Common errors when filing IRS 1040 - Schedule H include incorrect social security numbers and miscalculating tax credits or deductions. Reviewing the entire form for accuracy and ensuring all required fields are completed can significantly reduce filing mistakes.