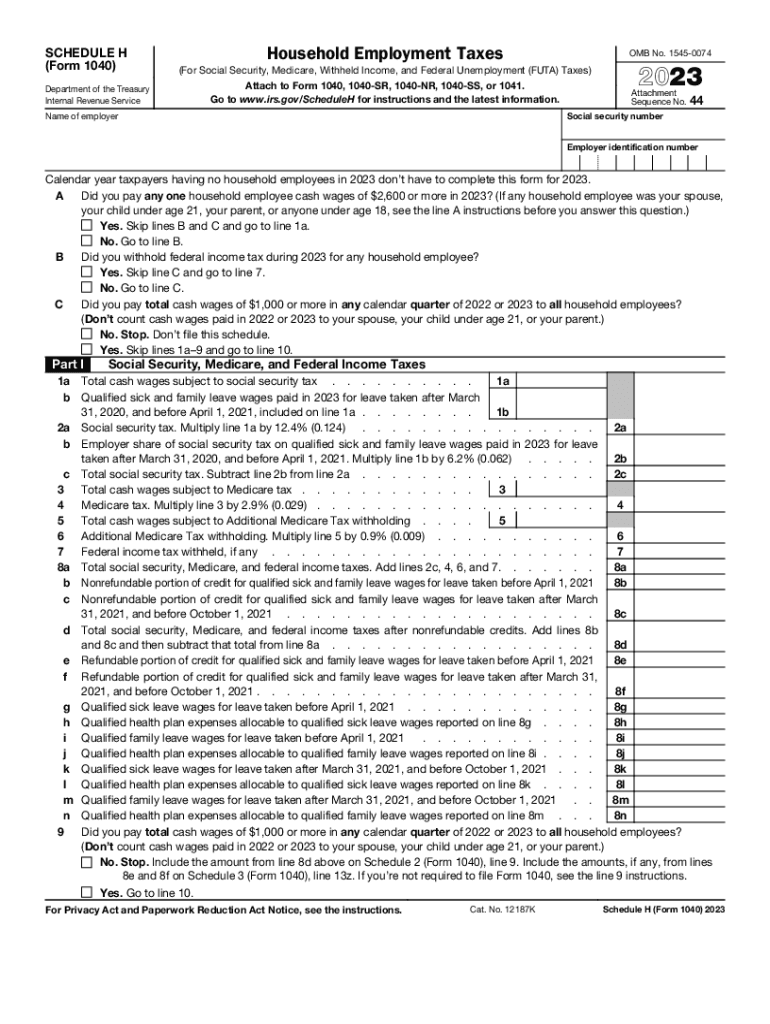

Who Needs Schedule H?

Everyone who hires someone to do household work must complete Form 1040 Schedule H. If the total wages paid to the household employees don’t exceed the particular threshold amount defined by the tax law, there is no need to fill out Schedule H. You must not file Schedule H if the household employees are independent contractors working at your residence occasionally. Usually, household employees are maids, nannies or other people who work around the house permanently.

What is Schedule H for?

Schedule H is for Household Employment Taxes. Everyone who hires people to do housework is considered an employer who must report employment taxes on this document. Schedule H is a part of Form 1040.

Is Schedule H Accompanied by Other Forms?

Generally, Schedule H is filed together with the individual tax return and other forms such as:

- Form W-2 serves to report wages that you’ve paid to the employees

- Form W-3 is for sending ?copy A of the W-2 to the Social Security Administration

When is Schedule H Due?

Schedule H is due on April 18th, 2017.

How do I Fill out Schedule H?

Schedule H is two pages long. It is divided into four parts preceded by the brief guide. It consists of the questions a taxpayer should answer “yes” or “no”. The answers define which part a taxpayer must complete.

- Part 1 shows social security, medicare and federal income taxes.

- Part 2 accounts for federal unemployment tax

- Part 3 is for total household employments tax

- Part 4 contains fields for a filer’s signature and the data the schedule was filled out.

Where do I send Schedule H?

Once completed, Schedule H is attached to the tax return and sent to the address specified in the tax return.